What is the tax brackets for 2011?

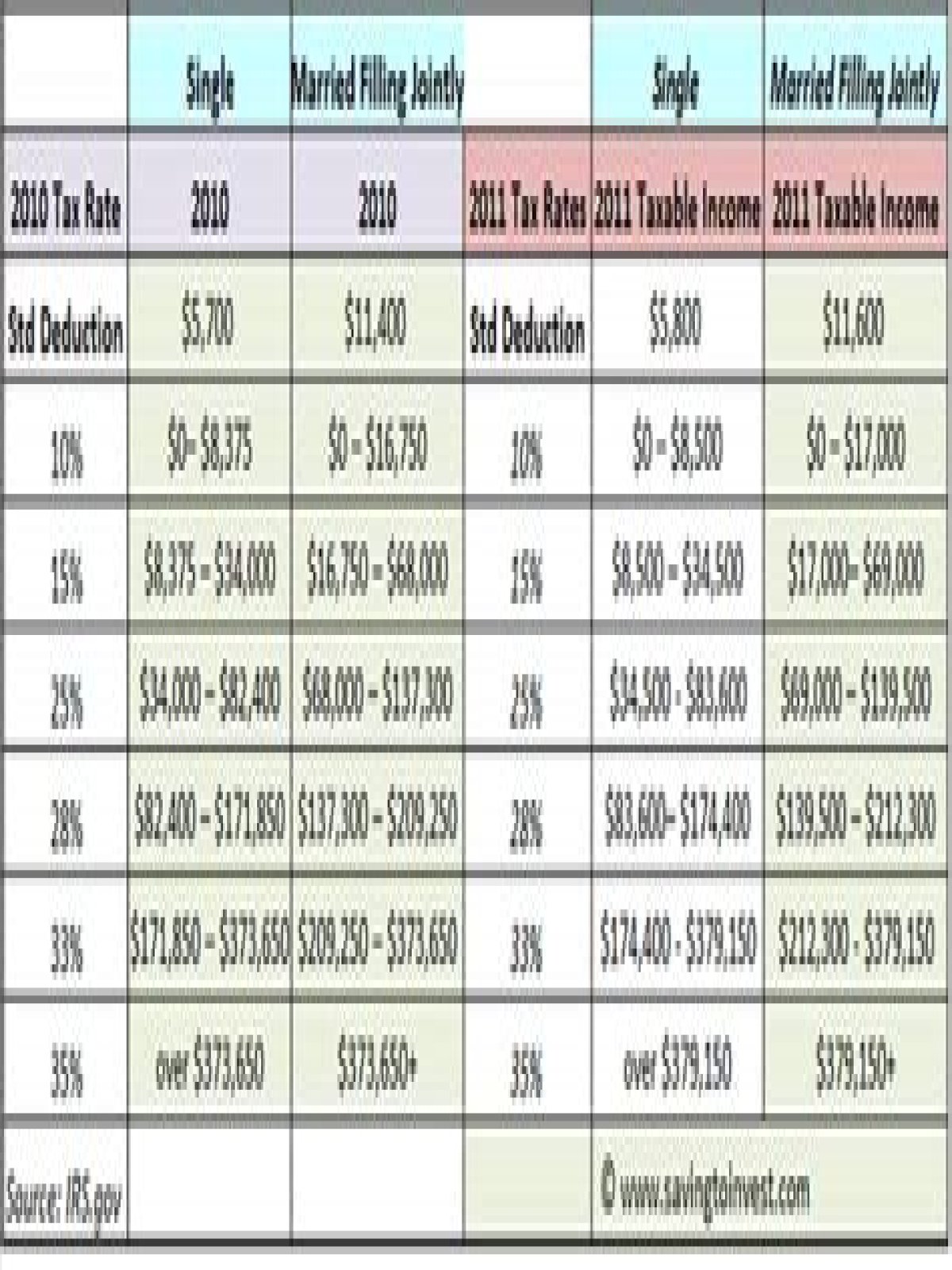

| Single filers | Married filing jointly or qualifying widow/widower | |

|---|---|---|

| 10% | Up to $8,500 | Up to $12,150 |

| 15% | $8,501 – $34,500 | $12,151 – $46,250 |

| 25% | $34,501 – $83,600 | $46,251 – $119,400 |

| 28% | $83,601 – $174,400 | $119,401 – $193,350 |

What was the highest tax rate in UK history?

99.25% The highest rate of income tax peaked in the Second World War at 99.25%. It was then slightly reduced and was around 90% through the 1950s and 60s.

How do you use the tax table?

How to Read Federal Tax Tables

- Step 1: Determine your filing status. The IRS allows you to choose any filing status that you are eligible for.

- Step 2: Calculate your taxable income.

- Step 3: Determine your income bracket.

- Step 4: Identify your tax filing status.

- Step 5: Find the amount of tax you owe.

Are 2020 and 2019 tax tables different?

Tax planning is all about thinking ahead. The 2020 tax rates themselves didn’t change. They’re the same as the seven tax rates in effect for the 2019 tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%. However, the tax bracket ranges were adjusted, or “indexed,” to account for inflation.

What was super tax in the UK?

Income Tax rates and bands

| Band | Taxable income | Tax rate |

|---|---|---|

| Personal Allowance | Up to £12,570 | 0% |

| Basic rate | £12,571 to £50,270 | 20% |

| Higher rate | £50,271 to £150,000 | 40% |

| Additional rate | over £150,000 | 45% |

Why file taxes married filing separate?

If your spouse is evading taxes or performing other illegal activities for gain, it may be best to file taxes separately. When you file a joint tax return, you are both liable for any tax deficiencies. There are innocent spouse rules to protect you in the event that your spouse is doing illegal activities that you do not know about.

What happens if I file taxes married jointly?

Earned Income Tax Credit

When should you file married filing separate?

Filing status. December 31 is an important day for separated couples. The IRS considers you married for the entire tax year when you have no separation maintenance decree by the final day of the year. If you are married by IRS standards, you can only choose “married filing jointly” or “married filing separately” status.

Which tax form should I use for filing married jointly?

If you file as married filing jointly, you can use Form 1040. If you and your spouse have taxable income of less than $100,000, you may be able to file Form 1040A.