What is GRSU on payslip?

This is used to make a payment to a staff member where it is the net amount that is specified but the payment needs to be grossed up before payment. To configure this option you must have an Allowances (PTA) record for Allowance Code ‘GRSU’ with Allowance Type ‘A’ and Amount Type ‘D’.

What is a NPA adjustment?

Pay Adjustments (NPA) Overview Increases are input as positive figures. Decreases are input as negative figures. You enter the Amount by which the pay is to be adjusted. Your adjustment does not replace an existing component. Pay Adjustments adjusts an existing component by the Amount.

What is NI EE and Ni Er on payslip?

EMPLOYEE NI / EE NI The amount being deducted for your National Insurance contribution. EMPLOYERS NI / ERS NI Employers also pay Employer’s National Insurance contributions on their employees’ earnings and benefits, which is summarised for reference on your payslip.

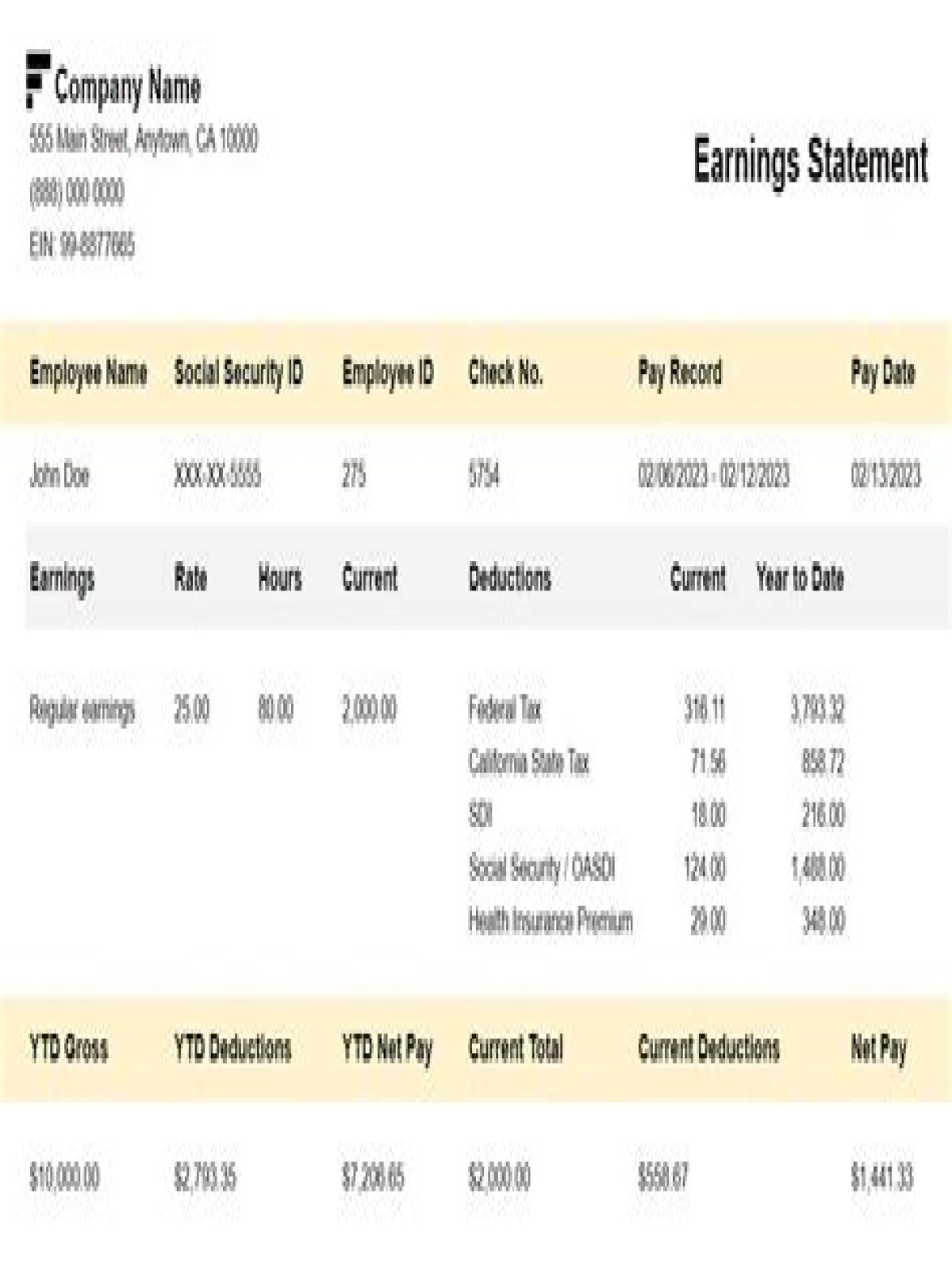

What are deductions on payslips?

They include tax and National Insurance. The total amount of any fixed deductions. These are deductions that don’t change from payday to payday – for example, union dues. An employer doesn’t have to give details of what these deductions are for, if they give a separate statement with these details at least once a year.

What does Eesp stand for?

| EESP | Employee Educational Scholarship Program Community » Educational — and more… |

|---|---|

| EESP | Educator Evaluation and Support Plan Community » Educational |

| EESP | Electrical Equipment Safety Program Academic & Science » Electronics |

| EESP | Electronic Enhancement of Supervision Project Academic & Science » Electronics |

Should holiday pay be shown on payslip?

Some employers have a practice of “rolled-up holiday pay”, which involves not paying holiday pay while the employee is on leave, but paying the employee an extra amount during the weeks that the employee works. Therefore, the employee’s payslips must show the amounts separately.

How can I recover my NPA?

Mainly recovery is done through the following aspects:

- Lok Adalats. The Lok Adalat is one of the alternative dispute redressal mechanisms set up by the government.

- Debt Recovery Tribunals (DRTs)

- Sarfaesi Act.

- Insolvency And Bankruptcy Code (IBC)

What happens if my loan becomes NPA?

What happens when a loan becomes NPA? When a loan becomes an NPA, Non-Performing Asset, the bank has the right to confiscate the property or asset purchased through the loan. They can then auction the asset to pay against the loan outstanding.

What does EE and ER stand for?

EE (Eligible Employee): An employee who is eligible for insurance coverage based upon the stipulations of the group health insurance plan. ER Total: The portion of an employee’s health insurance premium paid for by the employer.

What is Erni?

Employer’s National Insurance (ERNI) is a contribution that must be paid to HMRC by your employer.

What are PAYE deductions?

PAYE is the abbreviated term for ‘pay as you earn’ and refers to the amount of income tax that is deducted from your salary before you receive it. National Insurance and student loan repayments can also be deducted along with PAYE tax.